Commercial solar providers in Australia – comprehensive review & Comparison

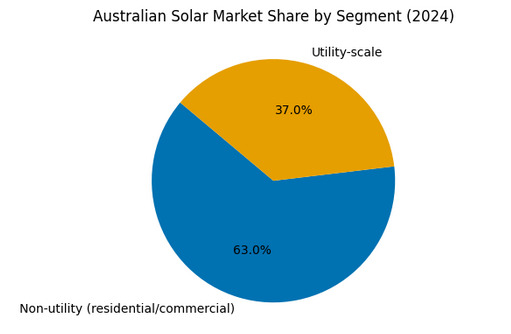

Australia’s solar market is among the world’s most mature. According to Mordor Intelligence’s 2024–25 market report, the non‑utility segment (residential and commercial systems) dominates the Australian solar market with around 63 % share of installed capacity.

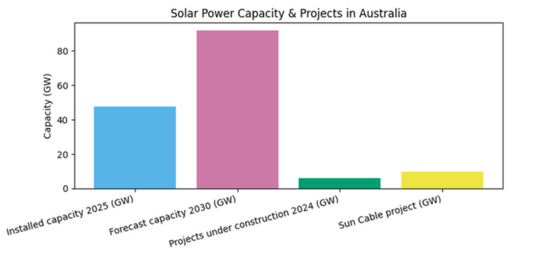

The report notes that Australia has potential rooftop solar capacity of ~179 GW, enough to produce 245 TWh annually. Utility‑scale projects account for the remaining market and were being built at a rapid pace, with 6.07 GW of capacity under construction and project costs of AUD 44.50–61.50 per MWh. Installed capacity is forecast to grow from 47.5 GW in 2025 to 91.74 GW by 2030, a 14.07 % compound annual growth rate. These figures illustrate why commercial solar is increasingly attractive for businesses seeking cost savings and carbon‑reduction benefits.

Market context and incentives

Australian commercial solar installations are driven by steadily falling equipment prices, rising grid electricity tariffs and a supportive policy environment. Systems up to 100 kW qualify for the federal government’s Small‑scale Technology Certificates (STCs), which provide an upfront rebate that can reduce system cost by 30–40 %. Larger systems earn Large‑scale Generation Certificates (LGCs), which provide an ongoing revenue stream until 2030. Providers such as Kuga Energy emphasise that return on investment for a 100 kW system is typically under 3 years and between 2–5 years for larger systems, noting that businesses should act before LGCs phase out. Additional state‑based incentives and corporate sustainability goals (e.g., net‑zero pledges) have led to rapid uptake of commercial solar PPAs and behind‑the‑meter systems.

The chart below summarises the market split between non‑utility and utility solar segments. Non‑utility installations (small commercial and residential) dominate the market.

Key commercial solar providers

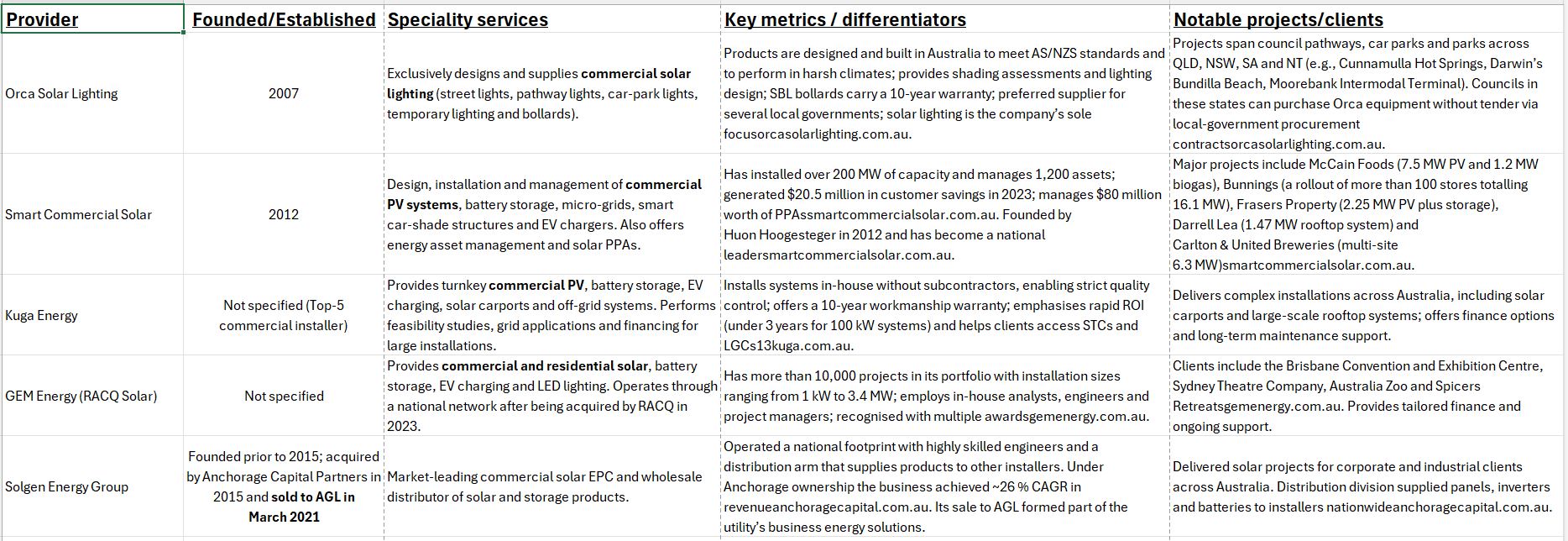

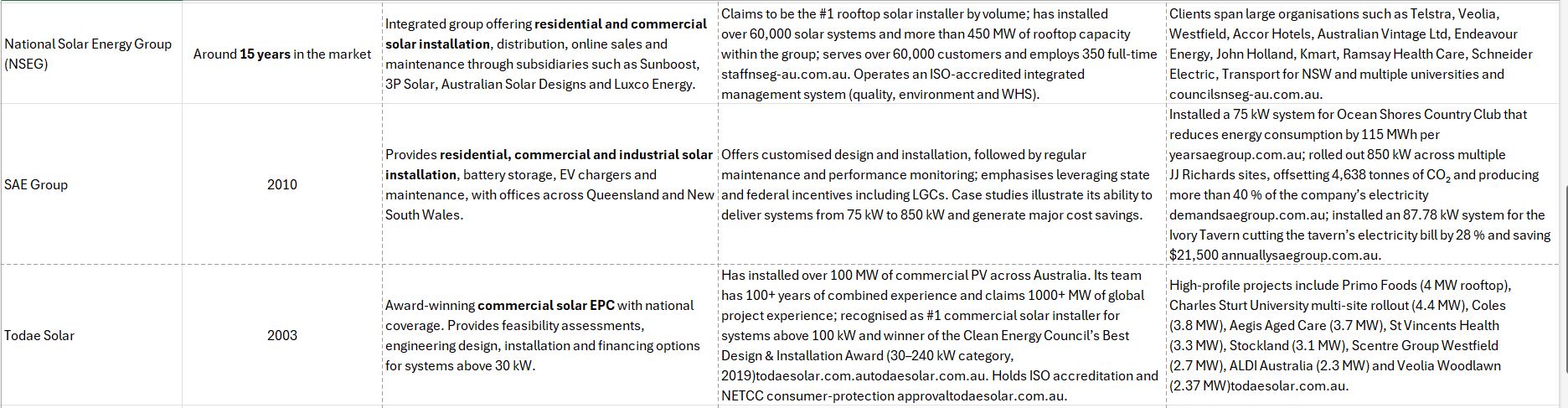

The table below summarises some of the most prominent commercial solar companies operating in Australia in 2025. It includes the provider’s founding date, specialty services, distinguishing metrics and selected projects or clients. Where possible, quantitative figures are provided (e.g., installed capacity or number of installations).

Additional players

The commercial solar market also contains many specialist installers and energy retailers not covered above. Regen Power, a West Australian firm, focuses on off‑grid and hybrid micro‑grid solutions for remote communities and mining sites. SAE Group operates across Queensland and northern New South Wales with mid‑sized installations. AGL, Origin Energy and EnergyAustralia have entered the commercial solar space through acquisitions of installers (e.g., AGL’s acquisition of Solgen in 2021) and offer rooftop systems and power‑purchase agreements to business customers. Market‑intelligence firm Sunwiz regularly publishes rankings of top solar retailers and installers, highlighting emerging companies such as 1KOMMA5°/Natural Solar, Smart Consult, NSEG and others.

Discussion and comparison

Specialisation vs integration

Providers fall into two broad categories:

- Specialist commercial EPCs (Orca Solar Lighting, Smart Commercial Solar, Todae Solar) focus on specific segments such as outdoor lighting, medium‑ to large‑scale rooftop systems and integrated micro‑grids. Their expertise is reflected in industry awards, engineered designs and long‑term performance guarantees. For example, Orca’s products are purpose‑built for harsh climates and meet lighting standards, while Smart Commercial Solar manages large portfolios and offers battery and EV charging infrastructure.

- Integrated installers and distributors (NSEG, SAE Group, Solgen, Kuga Energy, GEM Energy) operate across multiple segments—residential, commercial and industrial—and often control their own distribution channels. NSEG claims to be the largest rooftop installer by volume with over 450 MW installed, while Kuga Energy emphasises in‑house installation and rapid ROI. These companies leverage scale and procurement advantages, but may not provide the bespoke engineering services of specialist EPCs.

Scale and project complexity

The installed capacities and project sizes vary widely. Large commercial EPCs like Smart Commercial Solar and Todae Solar routinely deliver multi‑megawatt systems across hundreds of sites, while SAE Group demonstrates success with mid‑sized systems (75–850 kW) and focus on regional clients. Table 1 shows that Smart Commercial Solar has delivered over 200 MW of systems, whereas Todae Solar’s portfolio totals 100 MW but includes some of Australia’s largest rooftop solar projects (3–4 MW each). NSEG reports 450 MW across tens of thousands of installations, reflecting a strategy of high‑volume rooftop deployments. Kuga Energy does not disclose total capacity but positions itself among the top five installers and emphasises quality control.

Warranty and long‑term service

Warranty periods and ongoing service offerings are important differentiators. Orca Solar Lighting provides a 10‑year warranty on its bollard lights and emphasises reliability. Kuga Energy offers a 10‑year workmanship warranty and promises ROI within a few years. SAE Group highlights comprehensive maintenance packages and performance monitoring, while Todae Solar’s ISO accreditation and NETCC approval signal adherence to best‑practice standards.

Smart Commercial Solar offers long‑term asset management and PPAs, allowing businesses to outsource performance risk.

Clients and sector coverage

Most providers showcase diversified portfolios. Smart Commercial Solar works with food manufacturers, hardware retailers and breweries; Todae Solar’s clients range from universities and hospitals to supermarkets and aged‑care providers; NSEG and GEM Energy serve telecommunication companies, transport agencies and educational institutions; SAE Group supports clubs, waste‑management firms and hospitality venues. This diversity underscores the maturity of Australia’s commercial solar sector—virtually every industry now considers solar energy as part of its sustainability strategy.

Outlook

The Australian commercial solar market is poised for continued growth. The non‑utility segment already accounts for 63 % of installed capacity and is supported by robust rooftop potential (179 GW). Continued declines in PV and battery costs, growing corporate decarbonisation commitments, and emerging technologies such as behind‑the‑meter micro‑grids and energy‑storage PPAs will enable businesses to achieve cost‑effective energy independence. However, the gradual phase‑out of LGCs by 2030 means businesses should act soon to secure maximum incentives. Consolidation is another trend, with utilities like AGL acquiring commercial EPCs and global firms entering the market. Customers should therefore assess providers based on track record, engineering capability, warranty terms and financial stability.

In summary, Australia hosts a vibrant ecosystem of commercial solar providers ranging from specialised lighting companies to integrated EPCs with nationwide footprints. By understanding the differences among providers and considering long‑term service offerings, businesses can select the solar partner best suited to their operational and sustainability needs.

References:

https://orcasolarlighting.com.au/

https://www.mordorintelligence.com/industry-reports/australia-solar-power-market-industry

https://www.mordorintelligence.com/industry-reports/australia-solar-power-market-industry

https://www.13kuga.com.au/commercial-solar/

https://www.smartcommercialsolar.com.au

https://www.nseg-au.com.au/

https://www.smartcommercialsolar.com.au

https://www.nseg-au.com.au/

https://www.13kuga.com.au/commercial-solar/

https://todaesolar.com.au

https://www.13kuga.com.au/commercial-solar/

https://www.mordorintelligence.com/industry-reports/australia-solar-power-market-industry