Do I need insurance, and what types are recommended?

Over the course of your life, you may find yourself pondering the necessity of insurance and which types best suit your needs. Insurance is important in protecting your assets and providing peace of mind against unforeseen events. Understanding the various forms of insurance available—such as health, auto, home, and life insurance—can help you make informed decisions that safeguard your financial future. In this guide, we’ll explore what insurance you may need and recommend specific types for different life situations.

Key Takeaways:

- Personal Protection: Insurance provides imperative protection for personal assets, including health, property, and liability coverage.

- Types of Insurance: Recommended types include health, auto, homeowners or renters, and life insurance, depending on individual circumstances.

- Financial Security: Having insurance can safeguard against unexpected financial burdens from accidents, illnesses, or property damage.

Understanding Insurance

Your understanding of insurance is crucial for protecting yourself and your assets. Insurance serves as a financial safety net that can provide peace of mind in uncertain situations. By grasping its key concepts, you empower yourself to make informed decisions that safeguard your well-being.

What is Insurance?

Now, insurance is a contract between you and an insurer that provides financial protection against potential losses or damages. By paying a premium, you gain access to coverage in case of unexpected events, helping to mitigate risks in various aspects of your life, from health care to property damage.

Why is It Important?

For anyone, insurance is vital because it helps shield you from significant financial burdens that unexpected events can create. Whether you’re facing health issues, accidents, or natural disasters, having insurance ensures you can manage these challenges without overwhelming financial strain.

With various types of insurance available, such as health, auto, and home insurance, you can tailor your coverage to meet your specific needs. This protection not only offers peace of mind but also allows you to focus on your daily activities and long-term goals without the constant worry of potential financial loss. Understanding the importance of insurance equips you to make better choices for yourself and your family.

Types of Insurance

Assuming you’re considering getting insurance, it’s necessary to know the various types available to make informed decisions. The right insurance can protect you from financial burdens in the face of unexpected events. Here’s a brief overview of common types:

- Health Insurance

- Auto Insurance

- Homeowners/Renters Insurance

- Life Insurance

- Disability Insurance

After understanding these options, you can choose what best fits your needs.

| Type | Description |

| Health Insurance | Covers medical expenses |

| Auto Insurance | Covers your vehicle and liability |

| Homeowners/Renters Insurance | Covers your home and belongings |

| Life Insurance | Supports your loved ones financially |

| Disability Insurance | Replaces income if you can’t work |

Health Insurance

To safeguard your health, obtaining health insurance is vital. It helps cover medical costs such as doctor visits, hospital stays, and prescriptions. With a comprehensive plan, you can focus on recovery without the fear of overwhelming expenses.

Auto Insurance

Now, let’s discuss auto insurance, which protects you financially in case of accidents or theft. It typically includes liability coverage, collision, and comprehensive insurance to help you manage costs associated with vehicle damage or liability claims.

Auto insurance not only shields you from financial loss but also keeps you compliant with legal requirements. The type of coverage you choose can significantly impact your out-of-pocket costs and peace of mind while driving.

Homeowners/Renters Insurance

On the topic of homeowners and renters insurance, having coverage for your home and possessions is necessary. This insurance can protect you against loss from theft, fire, or natural disasters, ensuring you can recover swiftly if the unexpected occurs.

Homeowners/renters insurance provides you with the security of knowing your personal items are protected. Additionally, it often includes liability coverage, which can be crucial if someone is injured while in your home.

Life Insurance

With life insurance, you’re ensuring your loved ones are financially stable in the event of your passing. This policy pays out a designated sum to beneficiaries, helping them cover daily expenses or existing debts.

Types of life insurance vary, including term and whole life policies, allowing you to choose the best fit for your financial goals. Securing this insurance can provide peace of mind, knowing you’ve planned for your family’s future.

Disability Insurance

With disability insurance, you protect your income against unexpected circumstances that can prevent you from working. This coverage ensures that you receive a portion of your salary if you become unable to perform your duties due to a serious injury or illness.

Insurance policies for disability come in short-term and long-term options, allowing you to determine what best supports your financial needs. Investing in this type of insurance can be a wise decision for securing your financial wellbeing against unforeseen challenges.

Key Factors to Consider

Now, when evaluating your insurance needs, consider several key factors that will help you make informed decisions:

- Your personal and financial situation

- The type of coverage required

- Your existing assets

- Your risk tolerance

Any comprehensive evaluation will guide you in choosing the right insurance products for your specific life circumstances.

Personal Needs and Circumstances

For your insurance needs to be effective, you must assess your lifestyle, family dynamics, and potential risks. Factors such as dependents, home ownership, and employment stability will heavily influence the types of coverage you should prioritize.

Coverage Amounts

If you choose to purchase insurance, it’s important to determine appropriate coverage amounts that align with your needs. Underestimating or overestimating these amounts can lead to financial strain or inadequate protection.

For instance, life insurance should ideally account for future expenses, debts, and income replacement for your dependents. Homeowners insurance must cover reconstruction costs and personal property value, while auto insurance should meet state requirements and protect you against potential liabilities.

Premium Costs

There’s no denying that premium costs play a significant role in your insurance choices. Balancing coverage needs with what you can afford will be key to maintaining your financial health.

Plus, factors such as your age, health status, and claims history can significantly impact your premium rates. It’s wise to compare different policies and providers to find an option that fits both your budget and coverage requirements.

Pros and Cons of Insurance Types

Many people find it beneficial to weigh the advantages and disadvantages of various insurance types before making a decision. Below is a summary of the pros and cons to consider:

Insurance Pros and Cons

| Pros | Cons |

|---|---|

| Financial security against unexpected events | Monthly premiums can be expensive |

| Peace of mind | Some policies have exclusions and limitations |

| Potential for lower out-of-pocket costs | Complex terms and conditions |

| Encouragement for responsible behavior | Claims may be denied |

| Access to a wide range of services | Can lead to over-insurance |

Benefits of Having Insurance

Now that you understand the pros and cons, having insurance can greatly benefit you by providing a safety net for your financial well-being. It protects you from unexpected costs and gives you access to necessary services, contributing to your overall peace of mind during uncertain times.

Potential Drawbacks

For some, insurance may come with challenges. While it offers financial protection, the costs associated with premiums can consume a significant portion of your budget, and understanding the policy’s terms can be complex.

With various insurance options to choose from, you may find yourself paying for coverage that you may not use or need. Additionally, the possibility of denied claims can lead to frustration and mistrust, which is why it’s vital to research and analyze each policy before committing.

Tips for Choosing the Right Insurance

To choose the right insurance, consider these vital tips:

- Assess your specific needs and risks.

- Understand policy coverage and exclusions.

- Evaluate premiums against your budget.

- Consult a licensed insurance agent for personalized advice.

- Check the insurer’s financial stability.

After gathering this information, you can make a more informed decision.

Research and Compare Options

An effective approach to selecting insurance is to research and compare various options available in the market. You should consider the following:

| Coverage Options | Cost of Premiums |

| Customer Service Reputation | Claims Process Efficiency |

| Policy Limitations | Additional Benefits or Discounts |

Read Reviews and Seek Recommendations

Clearly, gathering insights from reviews and recommendations can significantly impact your choice of insurance. Engaging with others who have experience with a provider can shed light on customer service and claims handling.

Compare feedback across various platforms, such as trustable review sites and personal testimonials. This research can help you gauge overall customer satisfaction and identify any red flags regarding poor experiences. Reaching out to friends, family, or industry professionals for their opinions can also provide you with valuable information about reputable insurance providers.

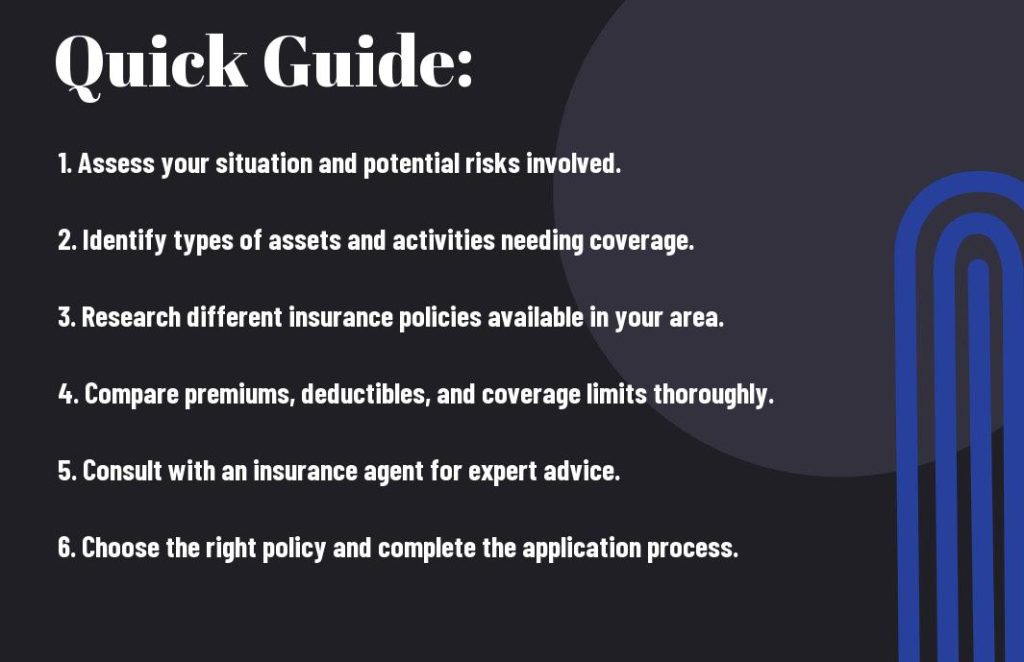

Step-by-Step Guide to Obtain Insurance

Once again, acquiring insurance involves a process that can be simplified by following key steps. This structured approach helps ensure that you secure the right coverage tailored to your specific needs.

Step-by-Step Process

| 1. Assess Your Needs | Determine what types of insurance are necessary for your situation. |

| 2. Gather Information | Collect relevant personal and financial details for accurate quotes. |

| 3. Get Quotes and Compare | Obtain quotes from multiple insurers and analyze the options. |

Assess Your Needs

The first step is to evaluate what types of insurance you require, based on your lifestyle and financial commitments. This might include health, auto, home, and life insurance, depending on your unique circumstances.

Gather Information

An important aspect of obtaining insurance is to compile necessary information that insurers will use to provide accurate quotes. This includes personal identification, financial details, and any specific risks related to the coverage sought.

Guide your data collection by creating a checklist that encompasses your income, existing policies, assets, and any previous claims you may have made. Having this information readily available will streamline the quote process and enhance your negotiation power.

Get Quotes and Compare

Clearly, obtaining quotes from different insurance providers allows you to see a variety of options tailored to your needs and budget. The process helps you weigh the benefits and drawbacks of each policy effectively.

Step-by-Step comparison of quotes is important for making an informed decision. During this stage, evaluate not only the premiums but also the coverage limits, deductibles, and any exclusions that may apply. This will help you choose a plan that best aligns with your requirements.

Comparison Factors

| Coverage Limits | Understand the maximum amount the insurer will pay for a claim. |

| Deductibles | Know how much you need to pay out-of-pocket before coverage starts. |

| Exclusions | Identify what events or situations are not covered by the policy. |

Summing up

Taking this into account, it’s evident that obtaining insurance is necessary for protecting your assets and financial stability. You should consider types such as health, auto, home, and life insurance, as each plays a significant role in safeguarding different aspects of your life. Evaluating your individual needs and risks will guide you in selecting the right coverage, ensuring peace of mind as you navigate life’s uncertainties.

Q: Do I really need insurance?

A: The necessity of insurance largely depends on your personal situation and the assets you wish to protect. In general, having insurance can provide financial security and peace of mind by safeguarding you against unexpected events like accidents, health issues, or property damage. For example, health insurance can cover medical expenses, while auto insurance is required by law in most places to cover damages from car accidents. Consider your lifestyle, assets, and potential risks when evaluating if you need insurance.

Q: What types of insurance are most recommended for individuals?

A: The most recommended types of insurance for individuals typically include health insurance, auto insurance, home or renters insurance, and life insurance. Health insurance ensures you have access to medical care without facing prohibitive costs. Auto insurance protects you against financial loss from vehicle-related accidents. Home or renters insurance safeguards your personal belongings, covering losses due to theft, fire, or other disasters. Life insurance, on the other hand, is imperative for those with dependents, ensuring financial support for loved ones in case of untimely death.

Q: How do I choose the right insurance policy for my needs?

A: Choosing the right insurance policy requires assessing your specific needs, budget, and risk tolerance. Start by evaluating the assets you want to protect and the potential risks you may face. Research various policies and providers to compare coverage options, premiums, and customer reviews. It may also be helpful to consult an insurance agent or financial advisor who can provide tailored advice based on your circumstances. Finally, ensure you read the fine print to understand exclusions and limitations of any policy you consider.

Source article: https://smallbiztoolbox.com.au/as-an-australian-business-do-i-need-insurance-and-what-types-are-recommended/