How do I create a business plan for my small business in Australia?

Starting a business requires a well-defined plan to guide your decisions and set realistic goals. In this guide, you will learn how to create a comprehensive business plan tailored to your small business in Australia. From understanding the market landscape to defining your business structure and financial projections, this step-by-step approach will help you articulate your vision and effectively communicate it to potential investors or stakeholders. Let’s probe the important elements that will make your business plan a powerful tool for success.

Key Takeaways:

- Research your market: Understand your industry, target audience, and competition to create a solid foundation for your business plan.

- Structure your plan: Include key sections such as an executive summary, market analysis, marketing strategy, operational plan, and financial projections to provide a comprehensive overview.

- Review and update: Regularly assess your business plan to ensure it reflects changes in the market or your business goals, allowing you to adapt and grow effectively.

Understanding the Types of Business Plans

A business plan is not a one-size-fits-all document. You can choose from different types of business plans based on your goals and needs. Here’s a breakdown of some common types:

| Type of Business Plan | Description |

|---|---|

| Traditional Business Plan | A comprehensive document detailing your business strategy. |

| Lean Startup Plan | A simplified version focusing on core aspects of your business. |

| Operational Plan | Details daily operations and processes. |

| Strategic Plan | Focuses on long-term goals and direction. |

| Pitch Plan | A concise presentation for investors. |

Perceiving the type of business plan you need will help guide your entrepreneurial journey.

Traditional Business Plan

Little did you know, a traditional business plan typically spans 30-50 pages, offering in-depth insights into various aspects of your business, including market analysis, financial projections, and operational strategies. This plan is meant to serve as a roadmap for your business’s growth and can be necessary when seeking funding.

Lean Startup Plan

With a lean startup plan, you focus on validating your business idea with less detail and fewer pages, making it an efficient choice for startups. This flexible approach allows you to adjust based on feedback rather than committing to a long, detailed business plan.

Plans created in this format prioritize necessary elements like your value proposition, key metrics, and competitive advantages. This allows you to pivot your business direction quickly, saving you time and resources while ensuring that you remain adaptable in the market.

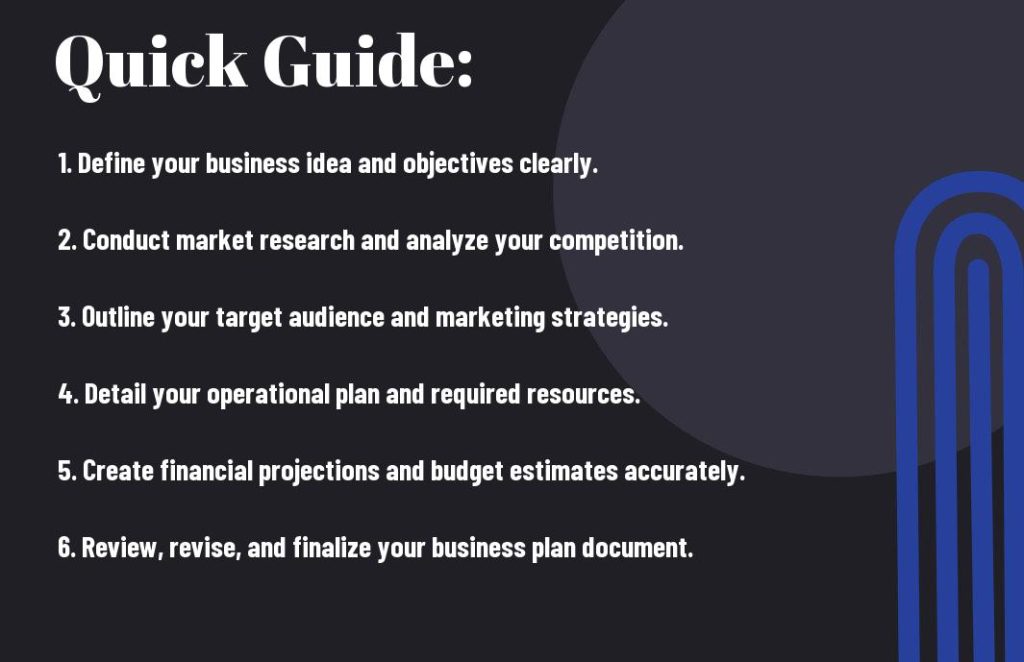

Step-by-Step Guide to Creating Your Business Plan

Even though crafting a business plan may seem daunting, breaking it down into manageable steps can simplify the process. Start with a clear outline that includes your business objectives, market analysis, business model, and financial projections. By following a structured approach, you can thoroughly develop each aspect of your plan. Below is a quick overview of the key steps:

| Steps | Description |

|---|---|

| Conduct Market Research | Analyze your market, target audience, and competitors. |

| Define Your Business Model | Outline how your business will make money. |

| Draft Financial Projections | Forecast your income, expenses, and profits. |

Conducting Market Research

StepbyStep market research involves identifying your target customers and understanding their needs, preferences, and buying habits. You can gather data through surveys, interviews, and analysing competitors. With this information, you can validate your business idea and refine your approach to better meet the demands of the market.

Defining Your Business Model

Even if you have a fantastic idea, defining how your business will operate and generate revenue is imperative for its success. Your business model should cover your target market, unique selling proposition, and revenue streams. This clarity will guide your operational strategy and help in securing funding.

A well-defined business model outlines where your value lies and how you intend to deliver it to your customers. This includes detailing your products or services, pricing strategy, and distribution methods. By articulating these elements clearly, you ensure that stakeholders and potential investors understand the viability of your business concept.

Drafting Financial Projections

Financial projections provide a roadmap for your business’s financial future. They include expected revenue, expenses, and profit margins over a specified time frame, usually three to five years. By accurately forecasting these figures, you can better plan for growth and attract potential investors.

It is important to base your financial projections on realistic and data-driven assumptions. Consider market trends, historical data, and potential economic challenges that could affect your business. By equipping yourself with solid financial insights, you will be better positioned to make informed decisions and adapt your strategy as needed.

Key Factors to Consider in Your Business Plan

Despite the complexity of creating a business plan, focusing on necessary factors can simplify the process. Consider including the following elements:

- Executive summary

- Market analysis

- Business structure

- Marketing strategy

- Financial projections

Assume that addressing these key factors will guide you in forming a well-rounded plan that effectively communicates your business vision.

Target Audience

To create an effective business plan, you must identify your target audience. Understanding who your customers are will help you tailor your marketing strategies and product offerings. Define their demographics, preferences, and pain points to effectively address their needs and foster engagement.

Industry Trends

Any successful business plan should reflect an awareness of industry trends. By staying updated on the latest market movements, you can position your business to take advantage of emerging opportunities and mitigate potential risks. This knowledge not only strengthens your strategies but also enhances your credibility with stakeholders.

Audience preferences, technological advancements, and socio-economic shifts are just a few indicators of industry trends. By analyzing these factors, you can anticipate changes and adjust your business model accordingly. This proactive approach ensures that you remain competitive and relevant in a rapidly evolving marketplace.

Tips for Writing an Effective Business Plan

Now, crafting an effective business plan requires careful thought and attention to detail. Consider the following tips:

- Keep your audience in mind.

- Use clear and straightforward language.

- Provide supportive data and evidence.

- Review and revise your plan regularly.

Recognizing these strategies can significantly enhance the quality of your business plan and increase its potential effectiveness.

Clarity and Conciseness

If you want your business plan to resonate with readers, focus on clarity and conciseness. Avoid jargon and overly complex sentences that may confuse your audience. Instead, aim for straightforward language that conveys your ideas clearly, ensuring that anyone can grasp the necessary elements of your plan.

Realistic Financial Planning

For your business plan to be credible, you must incorporate realistic financial projections. This entails setting achievable revenue forecasts, estimating operating expenses accurately, and considering potential financial risks. It’s necessary that you demonstrate a thorough understanding of your market and incorporate data that supports your financial assumptions.

Writing realistic financial projections can significantly impact your business plan’s viability. Carefully analyze past financial performance, industry standards, and market conditions to project future earnings and expenses. It’s beneficial to include various financial scenarios, such as best-case and worst-case outcomes, to showcase your understanding of uncertainties and your strategic planning capabilities. This approach not only strengthens your business plan but can also instill confidence in potential investors and stakeholders.

Pros and Cons of Having a Business Plan

Unlike some may believe, a business plan presents both advantages and potential drawbacks that you should consider.

| Pros | Cons |

|---|---|

| Clarifies your business vision. | Can be time-consuming to create. |

| Attracts investors and funding. | May require frequent updates. |

| Helps identify market opportunities. | Can be overly rigid. |

| Guides decision-making. | Costly if hiring consultants. |

| Improves strategic planning. | Risk of becoming outdated. |

Advantages of a Business Plan

The benefits of having a business plan extend beyond simply securing funding; it serves as a roadmap, guiding your decision-making and helping you navigate your market landscape effectively.

Potential Drawbacks

Cons of having a business plan include the time and effort needed to create one, which can be a significant commitment. Moreover, the process might lead to a plan that becomes too rigid, hindering your ability to adapt as circumstances change.

Pros also highlight that the initial investment of time to build a solid business plan may deter some entrepreneurs. Additionally, there may be costs associated with hiring outside help for the plan’s development, which could strain your budget in the early stages of your business.

Common Mistakes to Avoid

To create a successful business plan, it’s important to avoid common pitfalls that can hinder your progress. Many entrepreneurs overlook key areas such as financial projections, market research, and competition analysis. By sidestepping these mistakes, you increase your chances of developing a robust and actionable plan tailored to your specific needs and goals.

Overestimating Revenue

Mistakes in forecasting can set unrealistic expectations for your business. Overestimating your revenue may lead to inadequate financial planning, causing significant issues down the line. It’s vital to base your revenue projections on realistic data and market trends to ensure sustainable growth.

Neglecting Market Research

Now, many entrepreneurs underestimate the importance of market research in their business plans. Skipping this step can lead to misguided strategies and missed opportunities. You must be aware of the competitive landscape and customer needs to position your business effectively.

Understanding your target market enables you to identify trends, customer preferences, and potential challenges. Conducting thorough research will allow you to make informed decisions and tailor your offerings to meet consumer demands. It’s not just about knowing who your competitors are but also recognizing gaps in the market that your business can fill successfully.

Final Words

Conclusively, creating a business plan for your small business in Australia involves a structured approach that includes defining your business concept, conducting market research, and outlining your financial projections. By adhering to these steps and tailoring your plan to meet local regulations and market demands, you can effectively communicate your business vision to stakeholders and guide your operations. Take the time to refine your plan, and you will establish a solid foundation for your business’s future success.

Q: What are the necessary components of a business plan for my small business in Australia?

A: A comprehensive business plan typically includes several key components: an executive summary, a business description, market analysis, organization and management structure, marketing strategies, service or product line details, funding request, and financial projections. The executive summary provides an overview of your business, while the market analysis section examines your target audience and competitors. The organization and management section outlines your business structure, and the marketing strategies detail how you will attract customers. Additionally, clearly presenting your funding requests and financial forecasts is vital for potential investors or lenders.

Q: How can I conduct market research for my business plan in Australia?

A: Conducting market research involves several steps. Start by defining your target market and identifying potential customers. You can use surveys, interviews, and focus groups to gather insights directly from potential consumers. It’s also important to analyze industry reports and studies that can provide data on market trends and competitors. Various government resources, such as the Australian Bureau of Statistics (ABS), offer valuable statistical data. Utilizing both primary and secondary research will help you craft a well-informed market analysis for your business plan.

Q: What financial information should I include in my business plan?

A: Financial information is a critical part of your business plan and should include projected income statements, cash flow statements, and balance sheets. The income statement outlines expected revenues and expenses to calculate potential profit over a specified period. The cash flow statement details how money flows in and out of your business, highlighting your liquidity position. Lastly, the balance sheet offers a snapshot of your business’s financial health at a given moment, detailing assets, liabilities, and equity. Providing realistic financial projections, usually covering three to five years, can instill confidence in potential investors and lenders.

Source article: https://smallbiztoolbox.com.au/how-do-i-create-a-business-plan-for-my-small-business-in-australia/